- European stocks closed with losses owing to political instability

- Results season continues, with FCC quadrupling its losses

- Euro falls against the dollar to 1.0735 greenbacks

The banking sector was the main player on Monday's fiscal session once again. The Ibex 35 fell 1.11% to 9,357.3 points, held back by the banks. European stocks also closed in red as global political instability continues to reign on investors' minds.

- 11.456,000

- -0,10%

The six worst performing stocks on Monday were banks. Bankia was the biggest faller of the day after a fall of 3.52% to 0.96 euros. Banco Popular dropped 2.64% to 0.84 euros and closes its eight consecutive daily loss. On Friday, the bank published its quarterly results, which were lower than expected, and on Monday various firms published negative reports of the entity.

Banco Sabadell was the third worst performer after losing 2.34% of its value to 1.42 euros. Caixabank has also been in the lower part of the table after falling 2.31% to 3.46 euros. One of the heaviest stocks in the Ibex, Banco Santander, was 2.12% lower at 5.2 euros and Bankinter was close behind with a 2.1% fall to 7.40 euros. BBVA was the best performer amongst the banks, but still finished 1% lower.

On the gains side, only five stocks finished green. Técnicas Reunidas advanced 1.29% to 37.4 euros, the best performance of the day. It was followed by Grifols which gained 0.67% to 20.3 euros. Red Eléctrica closed 0.15% higher, while Merlin and Viscofran were slightly higher by 0.05%.

In the general stock exchange, FCC published its earnings. It made a loss of 165 million euros, almost quadrupling its losses. Investors punished the company as it fell 3.45% to 7.9 euros. However, OHL was the biggest faller with a drop of 6.47%.

OTHER MARKETS

In European markets there were also important falls. The Dax 30 fell 1.22% and the Cac 40 in France by 0.98%. The Ftse MiB in Italy was 2.21% lower after Unicredit fell 7% having laid off 3,900 employees. The Ftse 100 fell 0.22%.

Apart from Brexit, political instability shows no sign of letting up in Europe or the US. Donald Trump's interview with Bill O'Reilly is still dominating the headlines. Wall Street showed mixed results on Monday, the Dow Jones maintaining its 20,000 level.

Regarding currencies, the euro fell 0.47% against the dollar and is now worth 1.0735 greenbacks. Economic tensions are on the increase as Wolfgang Schaueble, German economy minister, blamed the ECB for being "too cheap" for the country. Draghi responded by saying that the bank doe snot manipulate the euro.

TECHNICAL ANALYSIS

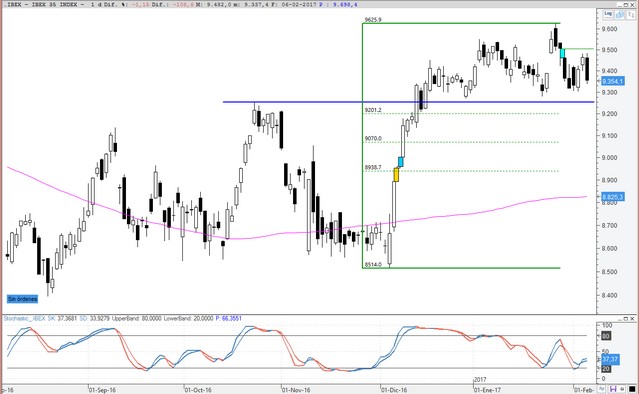

José María Rodríguez, Bolsamanía technical analyst, pointed out again that the index was heading downwards after attacking the resistance. "If we were situated weeks ago at 9,550 points in the short term, then we have a lower gap on Monday from last week, of 9,504 points," he said.

Basically everything points towards a visit towards the support of 9,250-9,280. While it's unlikely to perforate 9,250 points, we will have visited once again the trapped area of the last two months.

Noticias relacionadas

Mapa de los bajistas: así se distribuyen los 6.800 millones apostados contra la bolsa española

¿Busca ideas de inversión? Pues no pierda de vista estos cuatro valores del Continuo

Según la 'teoría de la Super Bowl' el Dow Jones caerá en 2017