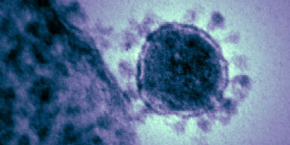

The Ibex 35 and the rest of European stocks have registered strong gains amid positive news about the coronavirus. Scientists in the United Kingdom have said there could be a vaccine and Chinese universities say they have found a cure. From the WHO, however, they have warned that there is still no effective therapy. The Spanish selective has risen 1.62% and has marked a new annual maximum at 9,717.80 points (the previous one was marked on January 2 at 9,691 at closing prices). Within the index, we highlight the strong increases in IAG, which has benefited from this good news about China, and also those of Siemens Gamesa (+ 6%), CaixaBank (+ 4%) and Ence (+ 6%).

- 11.457,100

- -0,09%

There is a feeling, therefore, that things would improve with respect to the coronavirus, although the worrying news continues. Donald Trump has said he is working "closely" with China to face the outbreak. WHO has stated, meanwhile, that the coronavirus is not a pandemic and that disinformation must be fought.

In the results chapter, companies such as Naturgy, Infineon, Vodafone or BNP Paribas have presented results. The Spanish company has reported a net profit of 1.4bn in 2019; and its president, Francisco Reynés, has commented that the company is open to corporate operations in the form of acquisitions.

Another of the protagonists has been Siemens Gamesa (+ 5.6%), after Iberdrola has sold its 8% stake to Siemens for 1.1bn. Both companies sign the peace after many months of disagreements.

As for other news of the day, the US president addressed the nation on Tuesday in the speech on the State of the Union in which he said that the "economy is better than ever." "Since the elections, we have created 2.4 million new jobs. Unemployment applications have reached their minimum level in 45 years. African-American unemployment is at the lowest rate ever recorded and unemployment of Hispanic Americans has also reached the lowest levels in history, "he stressed.

On the result of the primary of the democrats in Iowa, finally it is known after being delayed 24 hours by "inconsistencies". With just over 60% scrutinized, former Mayor of South Bend, Pete Buttigieg, has won by a narrow advantage against favorite, Bernie Sanders. This result is a surprise and in some ways paves Trump's path to victory in the presidential elections as there is not really a clear favorite among the Democratic candidates.

On the other hand, Brent oil rises 3.2%, to $ 55.72, driven by the actions that OPEC + wants to carry out, which discusses possible production cuts to prevent oil from continuing to fall. So far this year, Brent and West Texas fall 15%. On the other hand, the profitability of the Spanish 10-year bond rebounds slightly to 0.29% and the euro depreciates 0.38% and changes to $ 1,1001.

TECHNICAL ANALYSIS

"This Wednesday's session confirmed the formation of a double floor that we have talked about recently and, in addition, it can be said that the goal (theoretical minimum) of the pattern increase has also been met. And there we have it, attacking the resistance of 9,700 points and marking new annual highs, "says José María Rodríguez, analyst at Bolsamanía.

"The stochastic moment oscillator is clearly turned upward and still has a margin of travel, which leaves the doors open for the index to move towards the resistance zone that confers the upper part of the bullish channel, now at approximately 9,930 points, so, in summary, it would be said that our Ibex has a free track up to 10,000 points, "concludes this expert.

Noticias relacionadas

Trump presume de sus logros económicos durante el discurso del Estado de la Unión

La OMS dice que el nuevo coronavirus no es una pandemia, por lo que es crucial combatir la desinformación

Buttigieg supera a Sanders y lidera las primarias demócratas en Iowa