Ibex 35 has dropped -0.46%, to 9,646.60 points, after marking an intraday low at 9,581 integers. The United States has ordered attacks against Iranian and Iraqi military and has killed a powerful Iranian general, Qassen Soleimani, head of the Quds Force of the Revolutionary Guards of Iran. Abu Mahdi al Muhandis, commander of the Iraqi militia, has also died. This situation exponentially increases the tension between the US and Iran. This Thursday, Trump and the Iranian supreme leader, Ali Jamenei, faced each other on Twitter. Both want to avoid an armed confrontation but, at the same time, both said they will resort to force if necessary.

- 11.435,700

- -0,28%

Another implication of these attacks has been the sharp increases that are being seen in oil due to the possibility that everything that is happening with Iran will affect the supply of crude. The Brent barrel rises about 4%, to $ 68.66, while West Texas picks up to $ 63.24. Within the Ibex, this has benefited Repsol (+ 1.24%), one of the few bullish values of the day. For its part, gold, an active refuge par excellence, has climbed to a maximum of four months in this situation.

"The focus is on the market's reaction to the assassination of an important Iranian commander by the US, which has raised oil prices. Referring to what happened, Iran's Foreign Minister, Mohammad Javad Zarif, He described the murder as "an extremely dangerous and foolish escalation" and Iran's Ayatollah, Ali Khamanei, warned of "severe reprisals," said Danske Bank experts.

The falls in the stock markets come after the strong rises on both sides of the Atlantic in the first session of the year, with historical highs included in Wall Street. Asia, however, has already done it wrong this morning as the details of the geopolitical tensions between the US and Iran were known.

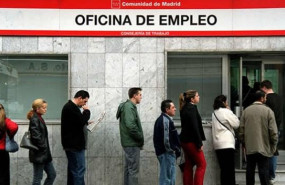

Investors are still pending the behavior of certain securities, such as banks, which yesterday did very well and today fall again. They are also paying special attention to macro data. In Spain, the December strike was known, which fell by 38,692 people in 2019, its lowest annual decline in seven years. In addition, after the agreement with ERC, everything suggests that Pedro Sánchez will be voted in as president on the second ballot on January 7. The socialist leader has secured the support of Teruel Existe and BNG, so, besides any last-minute surprise, he will be president on Tuesday.

Germany has also published the unemployment rate (it has remained at 5%) and has announced the December CPI, which has stood at 1.5% year-on-year. In the US, the December manufacturing ISM has unexpectedly declined to a 10 year low, a new sample of the year caused by the trade war on American industry.

In the opinion of Pantheon Macroeconomics, it is a "disappointing" fact caused mainly by the tariff war between the US and China. "We do not expect a sustained recovery in the short term. The 'Phase One' trade agreement maintains 25% tariffs on a large part of Chinese imports, and we see little chance of a comprehensive trade agreement to eliminate them before the November elections." , these analysts point out.

In other markets, the euro falls in value 0.1% and trades at $ 1,1160. Finally, the profitability of the Spanish 10-year bond falls sharply to 0.39%, while the Hispanic risk premium remains at 67 points.

TECHNICAL ANALYSIS

César Nuez, an analyst at Bolsamanía, established a 10% increase target for the Ibex in 2020, to near levels of 10,650 points. According to its assessment, the selective has confirmed a bullish figure in the form of 'shoulder-head-shoulder inverted'.

"This figure is a trend change, so we expect a good technical behavior of the Ibex 35 for this year. The objective of raising the figure results from projecting the amplitude of the head on the neck line, so it seems feasible that we can end up seeing, throughout 2020, an attack at the level of 10,643 points, highs of 2018 ", concludes this expert.

Noticias relacionadas

EEUU mata al general iraní Qassen Soleimani en un ataque ordenado por Trump

El petróleo se dispara un 3% tras la ofensiva de EEUU contra militares iraníes

El oro escala hasta máximos de cuatro meses por las tensiones en Oriente Medio