The Ibex 35 falls 0.75% to 9,051 points, weighed down by the negative behavior of Banco Santander after the presentation of its first quarter results. After completing its fourth consecutive week in positive on Friday, the index accumulates an increase of value of 6% in January and 10% from the lows of December.

- 11.467,300

- 0,24%

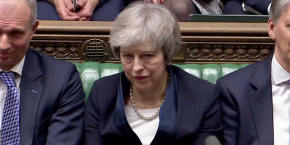

This Wednesday, investors also discount the decision of the British Parliament to allow Theresa May to renegotiate with the European Union (she rejected an extension to Brexit), while remaining cautious while waiting for the Fed to pronounce itself.

The British parliament rejected an extension of Brexit on Tuesday, but agreed that May could renegotiate the exit agreement with the EU. However, the EU has already said that it does not intend to change even one comma of this agreement. Thus, the uncertainty about this chaotic process is higher than ever.

On the other hand, the Fed will publish, as of eight o'clock in the afternoon, Spanish time, its monetary policy announcement. No changes are expected in the rates and Jerome Powell reaffirms the message that the US central bank will be more patient and flexible when it comes to raising interest rates.

FALL OF SANTANDER AFTER ITS RESULTS

As for Santander, the Cantabrian entity has announced that it gained 18% more in 2018, up to €7.8bn, and has specified that it fulfilled its objectives last year and also that it has fulfilled its objectives of the 2016-2018 strategic plan. However, its shares fell by 2% and fail to overcome the resistance of 4.40 euros per share.

Another big ballast for the Ibex is Telefonica, which is down 1.2%, followed by Iberdrola (-0.6%) and BBVA (-03%). On a positive note, Naturgy is up 1% despite reporting losses of €2.8bn in 2018 due to asset impairment of €4.8bn. Although the most bullish value of the Ibex is ArcelorMittal (+ 1.6%).

Also in the area of results, this Wednesday Apple is still news, which reduced its revenue, and had anticipated that the accounts would be impacted by the slowdown in China, but that rises 4% on Wall Street after slightly exceeding forecasts.

US AND CHINA PASS TO ACTION

The other big issue of the day are the negotiations that the United States and China begin today (they extend until tomorrow) to try to reach a commercial agreement. The market expects these meetings to conclude with an agreement, although it is true that there is skepticism, especially after the latest tensions between the US and the Chinese giant Huawei.

Steve Mnuchin, US Treasury Secretary, said Tuesday he expects "significant progress" to be made. "However, given the tense relationship between the US and China over Huawei's situation, trade talks could be affected," says David Madden, an expert at CMC Capital Markets in London.

In the macro data chapter, retail sales in Spain rose by 0.8% in 2018 and increased by five years. Although the most important thing of the day is that Germany has cut its forecast of GDP growth for 2019 to 1% from the previous 1.8%, which explains the negative behavior of the Dax (-0.6%).

In other markets, Brent oil rose 0.7% to $ 61.77. And the euro depreciates slightly by 0.13% in its cross against the dollar, up to $ 1.1419. Finally, the yield on the 10-year Spanish bond rose by almost 2% to 1.262%, while the Spanish risk premium advanced 2.5% to 107.40 points.

TECHNICAL ANALYSIS OF THE IBEX 35

"The key to this Wednesday is simple, simply Banco Santander has not been able to resist, and in the last few days we have commented repeatedly that the Cantabrian entity was trading at the gates of the resistance of 4.40-4.45 euros, which is the upper part of the last year's bearish channel, and after a clearly bullish opening in the title, higher than 2%, the title turned sharply downward, burdening the Ibex 35 " , explains José María Rodríguez, analyst at Bolsamanía.

"As for our selective, everything suggests that the short-term correction may have continuity towards the support area of 8,900-8,910 points, where we have a small bullish gap and above, as you know by now, we have the resistance of the 9,260 points ", adds this expert.

Noticias relacionadas

¿Qué esperar de la Fed? Paciencia y flexibilidad, los nuevos mantras de Powell

La macro y las empresas obligan a EEUU y China a ultimar un pacto esta semana

El Parlamento británico rechaza retrasar el Brexit pero respalda seguir negociando con la UE

Apple reduce sus ingresos, pero sube un 6% al superar previsiones