- Federal Reserve will decide whether to raise interest rates or not

- Investors taking a break after last week's rally

The Ibex 35 has closed 0.91% lower at 9,905.10 points as the index was the worst performing market among its European neighbours, which closed with with more moderate losses. "Super Wednesday" awaits investors tomorrow.

- 11.467,300

- 0,24%

The losses were across the board for the Ibex, but the fall of 2.12% by Repsol due to falling oil prices hurt the index badly. Tecnicas Ruidas was the biggest faller on the day at -2.52%, followed by Banco Popular (-2.25%).

Telefonica fell close to 2% after announcing an exchange of 1.4% of its capital for 6% of German operator KPN through Telefonica Deutschland.

The only positive stocks in the Ibex were Merlin Properties (+1.19%), Inditex (+0.35%), a day before it presents its results; and Meliá Hotels (+0.2%). In the general stock exchange, there were significant losses for Prosegur (-3.68%) and Sacyr (-2.4%), while there were gains for Reno de Medici (+4.46%) and San José (+2.98%).

Several figures were released on Tuesday, such as inflation for Spain in February, situated at 3% for the second consecutive month.

The OCDE improved to 2.5% from 2.3% its forecast for economic growth in Spain during 2017, at the same time as it asserted that the Spanish banking sector had room to keep carrying out consolidation operations in the sector.

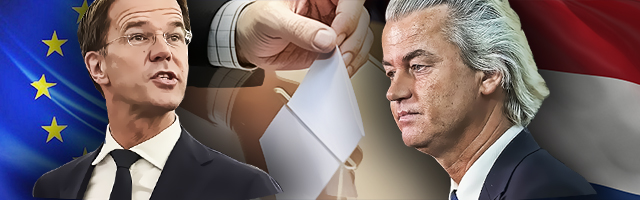

Tomorrow will see the long-awaited rise in interest rates from the Federal Reserve, as well as the results of the elections in Holland.

In the UK, it appears likely that the activation of Brexit will have to wait. Brexit minister David Davis reaffirmed the government's intention to invoke Article 50 as planned, but it will not happen today.

TECHNICAL ANALYSIS

"The falls of today's session do not have a huge importance from a technical point of view. LEs so if we take into account that they come after such a strong rally of 10% since the lows of February. As always we like to remember that the markets move in periods of rises and adjustments," said José María Rodríguez, Bolsamanía analyst.

"Here we are, draining the gaisn we accumulated in recent weeks. Looking at the graphic we can't find supports at 9,600-9,620. In fact I keep pointing towards BBVA, which last week was able to head towards the resistance of 6.6 euros, and we still don't discount the possibility of doing it."

Noticias relacionadas

Inditex afronta sus cuentas como el peor 'peso pesado' del Ibex en 2017

El Ibex 35 pierde el 10.000 mientras espera la llegada del 'Supermiércoles'

La 'amenaza Wilders': los cuatro escenarios de las elecciones de Holanda para las bolsas europeas

KPN (Slim) toma el 1,4% de Telefónica a cambio del 6% de la filial alemana en canje de 740 millones

El Reino Unido iniciará la desconexión con la UE a finales de mes, después de obtener luz verde en el Parlamento

La OCDE mejora su previsión de crecimiento para España hasta el 2,5% en 2017