The Ibex 35 closed the session with a fall of 0.26%, to 9,075 points, although the week ended with a rise of 1.80%. In the accumulated of November, the main indicator of the Spanish stock market has added 2.07%. The rest of European stocks have also ended in red (Ftse 0.89%, Dax: 0.34%, Cac: 0.05%) on the day on which the highly anticipated G-20 summit in Argentina kicks off.

- 11.473,900

- 0,33%

Within the Spanish selective, Telefónica (+ 1.08%) was the most bullish company in the day after the presentation of its new strategic plan. The company's CEO, José María Álvarez-Pallete, opened the door to expanding to new countries and highlighted the opportunities to capture profitable growth.

On the red side of the table, Dia drops by almost 6% and became again the most bearish value. The shares of the distributor maintain their free fall and have accumulated losses of more than 17% in the week, which is already close to historical lows, located at 0.62 euros (quotes at 0.66 euros at the close). The Ibex 35 has also been affected by Grifols, Mediaset and Cie Automotive, with falls of over 3%.

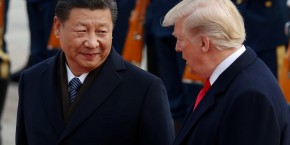

G-20 SUMMIT

Donald Trump and Xi Jinping meet tomorrow and the experts are divided among those who believe that there will be results from this meeting and those who are not so optimistic. What seems to be ruled out is that the appointment ends up muddying relations even more. d.

"We believe that a 'ceasefire' between China and the US will be reached. The G-20 will also focus on other aspects, such as the role of Saudi Crown Prince in the assassination of journalist Jamal Khashoggi and the renewed tensions between Russia and Ukraine ", indicate the experts of Danske Bank. It should be remembered that Trump has canceled his scheduled meeting with Vladimir Putinfor the latter reason.

In the commodity market, the Brent crude oil barrel has been trading downwards at the close of the Spanish market, with a fall of 1.61%, to 58.55 euros. For its part, in the currency market, the euro has been changed to 1,132 dollars.

TECHNICAL ANALYSIS

"The 2% rises in the accumulated of the week were acquired on Monday since the rest of the week has been rather a lateral or consolidation movement. We have to see if we will fill in (totally or partially) the bullish gap from this Monday, by definition support, at 8,916 points, "says José María Rodríguez, analyst at Bolsamanía.

"On the other hand, the maximum of the week has been marked at 9,199 points, staying again below the resistance we have at the last decreasing maximum (9,230).

"The downside of the current situation is that numerous resistances converge between the 9,200 and 9,350 points. The positive is that we are not far from them and we still have two of the heavyweights with desire to go up (Telefónica and Inditex) ", explains the expert.

"For the first time in a long time and without precedent the Ibex is stronger (in the last month and a half) than the rest of its European neighbors: the Ibex is trading at 5% from the minimum in October and Europe is at 3% from there, "he concludes.