The Ibex 35 closed with strong falls of 2.31% (8,650 points) and lost the key support of 8,740 points. The rest of European stocks also fell between 1% and 2%. The Spanish selective was burdened on Thursday by the banks and the values of the tourism sector.

- 11.720,900

- -1,50%

The spread of the Delta strain of Covid and the re-imposition of restrictive measures by the different countries or Autonomous Communities here in Spain is beginning to be an element of clear concern for the markets.

In Japan, the authorities have declared a state of emergency due to coronavirus during the Olympic Games and until August 22. The French Government, for its part, has advised against traveling to our country and Portugal via the Delta variant.

Returning to our selection, the strong cuts by ArcelorMittal, tourism stocks (especially Meliá) and banks stood out, with relevant decreases in Sabadell, Santander, BBVA ... On the positive side, only Solaria and PharmaMar have appeared.

The falls in the banking sector, both in Spain and in the rest of Europe, have had a lot to do with the rise in the price of bonds as the Covid situation worsens and investors seek safer investments. This has led to long-term bond yields to decline sharply.

"One of the sectors that is being most affected by this behavior of bond prices is the banking sector, since the fall in long-term interest rates and the flattening of the interest rate curve play very against their interests, by putting pressure on their margins down, "explained Link Securities experts in their report this Thursday.

Wall Street also trades with significant declines after closing this Wednesday with moderate increases after the content of the latest Fed minutes was known. "The minutes do not offer any concrete indication on when it could announce a calendar to reduce its asset purchases, although they do state that 'several members' (that is, more than two, but not many) mentioned that they expected the conditions to begin to reduce the pace of asset purchases would be fulfilled somewhat earlier than they had anticipated in previous meetings ", highlight the Berenberg experts.

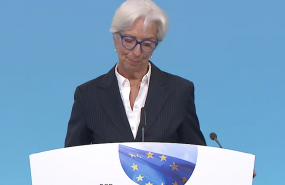

THE ECB RAISES ITS INFLATION TARGET

The European Central Bank (ECB) announced this Thursday the results of the review of its monetary policy strategy, the first it has carried out since 2003. As some media had anticipated, the issuing institute has decided to review its inflation target and allow consumer prices skyrocket when deemed necessary. The central bank's Governing Council has agreed to raise it to 2% and leave room to exceed it.

"The Governing Council considers that the best way to maintain price stability is to pursue an inflation objective of 2% in the medium term. This objective is symmetrical, which means that the negative and positive deviations of inflation with respect to the target are equally undesirable, "the ECB said in a statement.

The latest US unemployment benefit claims figures will also be a focus for investors this Thursday. Economists forecast that there will be 350,000 first applications for unemployment benefits in the week ending July 3.

OTHER MARKETS

The euro trades at $ 1.1838. Oil fell 0.5% on average, to $ 73.13 for Brent and $ 71.77 for West Texas.

Gold and silver rose moderately to $ 1,816 and $ 26.31, respectively.

Bitcoin is down 6% ($ 32,558) and Ethereum more than 9% ($ 2,150).

The yield of the 10-year American bond yields to 1.271%.