The Ibex 35 rises 0.3%, to 8,348 points, after marking an intraday low at 8,278 integers. This after it 'punctured' yesterday in its attempt to overcome the highs of the year. Bolsamanía analysts do not rule out that it seeks to cover the bullish gap that it left on Monday at 8,225 points before attacking those highs again. "In spite of everything", they add, "its technical aspect is good and everything seems to indicate that we could end up seeing the 8,439 points surpass", highs from the beginning of January, comments César Nuez, analyst at Bolsamanía and head of Trader Watch.

- 11.720,900

- -1,50%

Within the selective, the increases in Telefónica, Iberdrola, Endesa and Repsol and the cuts in Inditex, Acerinox, Cellnex, Solaria or PharmaMar stood out.

In the Continuous Market, Duro Felguera has shot up after confirming the rescue of SEPI last night, which will inject 120 million euros into the Asturian company.

At the moment, investors are still watching the yields of sovereign debt. The yield on 10-year US Treasuries remains at 1.46%, after hitting an annual high at 1.6% last week, in a move that has sparked concern about a possible rebound in inflation. However, calm has prevailed in the bond market during the day.

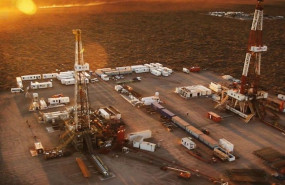

Another notable news is that the Organization of the Petroleum Exporting Countries (OPEC), together with Russia, has decided not to increase its monthly oil production. In addition, Saudi Arabia has confirmed that it will maintain its voluntary cuts, which boosts the price of 'black gold'. A barrel of Brent crude rebounds almost 5%, above $ 67.

GERMANY RELIEVES RESTRICTIONS

On the evolution of the pandemic, Germany is in the spotlight this Thursday after Chancellor Angela Merkel announced yesterday that she is extending the confinement until the end of March but that the de-escalation plan is already underway to gradually eliminate the restrictions. "Spring 2021 will be different from 2020," Merkel said.

The German Chancellor has announced that German citizens will have the possibility of taking an antigen test every week, which will be paid with a symbolic co-payment of one euro.

Although it is not yet under control, progress in vaccination in European countries is showing a positive evolution, which allows investors to be optimistic, especially for the second half of the year.

UNEMPLOYMENT, SALES, POWELL ... AND OIL

This Thursday's agenda has brought relevant data for investors. Unemployment in the euro zone remained at 8.1% in January, while retail sales fell 5.9% in January compared to the previous month. In addition, the weekly unemployment data in the US has been better than expected.

In addition, the Chairman of the Federal Reserve (Fed), Jerome Powell, will give a speech in the afternoon. "We believe Powell will repeat that the Fed is patient and will not tighten monetary policy prematurely. We will listen carefully to any comments on rising (bond) yields and inflation expectations," Danske Bank analysts say.

In other markets, the euro falls in value 0.16% to $ 1.2044, while the ounce of gold rises 0.1% to $ 1,717. For its part, bitcoin falls 2%, to $ 49,700; and the profitability of the Spanish 10-year bond relaxes to 0.37%.