The falls in US technology, the confrontations in the Brexit negotiations, the words of the European Central Bank (ECB) ... nothing has had too much impact on the Ibex throughout this week (it falls today by 0.4%, up to 6,970 points). "Everything remains the same," says César Nuez, an analyst at Bolsamanía and head of Trader Watch, and this is probably the phrase that best sums it up.

- 11.656,600

- 0,39%

The Spanish selective remains in an "eternal" lateral movement, trading in the vicinity of 7,000 points, without confirming even the slightest sign of strength that makes us think of a recovery in its price series, explains Nuez. "Below, key support is at 6,788 points, while above we will not see a sign of strength again until resistance at 7,321 points is overcome," he adds.

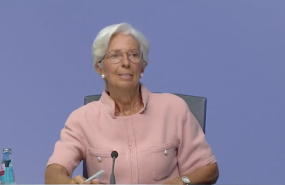

Meanwhile, as expected, the ECB did not offer news on Thursday, with Christine Lagarde sending the markets a message of confidence about the recovery. All of Europe this Thursday remained considerably indifferent to the words of the body, and ended with moderate falls.

On the other side of the Atlantic, Wall Street ended the session with falls of 1.5% on average (-2% on the Nasdaq). Democrats have blocked in the Senate the aid plan to alleviate the effects of Covid-19 proposed by the republicans. They argue that this measure is too poor for the damage the pandemic has caused. In Asia, the session ended with a predominance of green numbers.

In the United Kingdom, in addition to being aware of the development of growing tensions with the European Union (EU), investors are paying attention this Friday to the July GDP estimate, which has risen by 6.6%, below the 6 , 7% expected and 8.7% from the previous month. "Given the high Brexit uncertainty at the moment, we do not expect the release to have a significant impact on the pound," say experts at Danske Bank. In Germany, the August CPI stood at -0.1% per month compared to the -0.1% expected and the previous -0.5%. In Spain, the CPI for August stands at -0.5% and has been negative for five months.

Finally, it should be noted that investors are already looking to next week, when there is a meeting of the Federal Reserve (Tuesday and Wednesday), a meeting of the Bank of England (Thursday) and options and futures expiration ('quadruple witch hour'), the Friday.