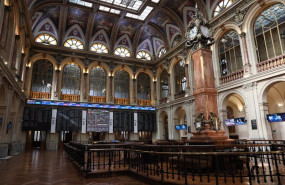

Strong falls throughout Europe, as the Ibex closes with cuts of 1.23% to 9,070 points. The fact that the main Wall Street indices are trading sharply lower does not help. Within the Spanish index, the tremendous volatility that has been experienced in Banco Sabadell early in the morning stood out, which opened with a drop of 9% and which quickly reduced the red numbers (it has closed with falls of 1.16%). The bank was interrupted by high volatility, with a very high trading volume.

- 11.436,800

- -0,27%

Among the Ibex securities that have fallen the most are ArcelorMittal, PharmaMar, Amadeus and Meliá. On the positive side, only four titles appear, with very tepid rises, Cellnex, Telefónica, Merlin and Red Eléctrica.

The Eurozone CPI for April (+ 1.6%) and the minutes of the last meeting of the Federal Reserve (Fed) are the two main appointments on today's macro data agenda.

"This afternoon we have the latest Fed minutes from last month, a finding that predated the surprise employment report earlier this month. At that meeting, the central bank acknowledged the recent improvement in US economic data, but also reiterated that they were still far from the kind of results-based data necessary to alter their current policy stance, denying any prospect of a short-term reduction, "CMC Markets experts recall in their daily report. "Given the recent payroll report, this caution was well founded," these analysts add.

The macro calendar also includes the UK CPI for April, which has doubled to 1.5%. For its part, from the political point of view, the tension between Spain, and by extension the EU, and Morocco, continues to be one of the main issues.

FALLS IN THE 'CRYPTOS'

Bitcoin has dropped below $ 40,000 for the first time in 14 weeks.

The digital currency has sunk more than 13% and has hit an intraday low at $ 38,585.86 (now it stands at $ 39,177, -9.13%). This is the lowest level since February 9, the last time it fell below $ 40,000.

The negative news of the last week has dampened sentiment towards bitcoin. On May 12, Tesla CEO Elon Musk said that the electric car maker had suspended the possibility of buying its vehicles with bitcoin, citing environmental concerns about the so-called 'mining' process to obtain the cryptocurrencies. In this process, powerful computers are used to solve complex mathematical puzzles that allow transactions with bitcoin.

Musk's comments caused more than $300 billion to disappear from the entire cryptocurrency market value in a day.

The announcement to suspend payment with bitcoin came just three months after Tesla revealed that it had bought bitcoin worth $ 1.5 billion, and that it would start accepting it in exchange for its products.

Earlier this week, the CEO of Tesla clarified that the company "has not sold any bitcoin."

On the other hand, this Tuesday, three Chinese organizations from the banking and payments sector issued a statement in which they warn financial institutions not to conduct business related to virtual currency, including trading or exchanging fiat currency for cryptocurrencies.

Ethereum is sinking 15% at this time, to $ 2,855.

OTHER MARKETS

The euro is now trading at $ 1.2205. Oil fell 2% to $ 67.46 for Brent and $ 64.27 for West Texas.

Gold fell 0.6%, to $ 1,856, and silver 2% ($ 27.76).

The yield on the 10-year American bond stands at 1.659%.