The Ibex 35 has started the session with strong falls that have gone over 1%, has then become flat and has closed with increases of 0.23%, up to 9,051.70 points, after the optimistic statements of Christine Lagarde, President of the European Central Bank (ECB).

- 11.442,700

- -0,21%

The French central banker assured this Monday that "the economic outlook is bright" and growth is accelerating. "The outlook for the euro area economy is bright as the pandemic situation improves, vaccination campaigns advance and confidence begins to build. We expect economic activity to accelerate from this quarter," she added.

On inflation, she commented that "it has recovered in recent months, largely due to transitory factors, including strong increases in energy prices. Headline inflation is likely to rise further towards the fall, reflecting factors temporary ".

In his view, the ECB must "remain vigilant and ensure that policy support continues to provide a bridge over the pandemic and well into recovery. The European approach taken during this crisis is a great achievement and should be further strengthened" .

Regarding values of the Ibex, PharmaMar and Grifols have been the most bearish values, while CIE Automotive, ArcelorMittal, Iberdrola and CaixaBank have led the gains.

Investors watched the Spanish index turn last week after setting new yearly highs earlier in the week. The experts at Bolsamanía warn that, if it loses 9,000, we could end up seeing declines to 8,800 points. "Despite the falls, its technical aspect is still clearly bullish. We would see a positive signal again with a close above 9,200 points," they explain.

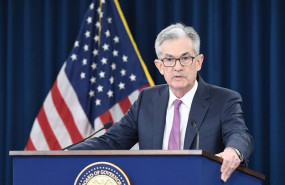

THE FEDERAL RESERVE

The latest declines in the markets have been motivated by the meeting of the Federal Reserve (Fed), which last week raised its inflation forecasts for the year considerably and brought forward the date to carry out its first rate hike to 2023 .

St. Louis Fed Chairman James Bullard said on Friday that it is natural for the central bank to lean a bit more to the 'hawk' side and that he sees the first rise in interest rates as early as 2022.

Regarding this Monday's agenda, at the Menéndez Pelayo University in Santander, Nadia Calviño, second vice president and minister of Economic Affairs, and Carlos Torres, president of BBVA, spoke about pardons and EREs. In China, today there was a meeting of the Chinese Central Bank, which has maintained interest rates for the fourteenth consecutive month.

MARK ZANDI EXPECTES FALLS OF UP TO 20%

Mark Zandi, chief economist at Moody's Analytics, expects the Fed's more aggressive stance to lead to market declines of 10-20%.

And, unlike the cuts in recent years, Zandi estimates that there will not be a strong recovery, especially since the market is so overvalued. He estimates that it could take a year to return to current levels.

"The headwinds are picking up for the stock market," Zandi said on CNBC's 'Trading Nation' show on Friday. "The Federal Reserve has to change gears because the economy is very strong," he added. Zandi suggested that the correction may already be underway because investors are starting to freak out.

OTHER MARKETS

The euro rises in value 0.27% and trades at 1.1883 dollars. Oil fell slightly, to $73.26 dollars for Brent and 71.47 dollars for West Texas.

Gold advanced 0.3% to $1,774, and silver fell 0.1% to $25.92.

Bitcoin falls sharply (-8%), to $ 32,360, while Ethereum is down 11%, to $ 1,952.

The yield of the 10-year American bond rebounded to 1.47% while the yield of the 10-year Spanish bond advanced to 0.46%.

Noticias relacionadas

Fuertes caídas en Wall Street, con el Dow Jones firmando su peor semana desde octubre

Los tres riesgos que acechan a las bolsas europeas y que pueden frenar las subidas

Bullard (Fed): "La inflación ha superado lo previsto, el debate del tapering ha empezado"