The Ibex 35 rose 0.47%, to 8,637.80 points; and it has approached annual highs as the world's major stock exchanges (Dax, Stoxx 600, Dow Jones, S&P 500) have come to a halt along the way after hitting all-time highs. In Europe, chaos continues around the AstraZeneca vaccine, whose use has been suspended in Spain for those under 60 years of age, while the situation of the pandemic in general, and of vaccines in particular, continues to be worrying in the Old Continent . In Italy, authorities confirmed 13,700 new cases and more than 620 deaths from Covid on Wednesday.

- 11.656,600

- 0,39%

Among the blue chips, the negative behavior of Repsol and Santander stood out, while Iberdrola was the most bullish, along with Ferrovial. Renewable energy companies such as Solaria and Siemens Gamesa have led earnings alongside Grifols.

At the bottom of the table, companies associated with tourism have appeared, such as Meliá and IAG, which have fallen after the uncertainty caused by the AstraZeneca vaccine.

On the other hand, Bolsamanía has published that the ERE of BBVA will focus on its financial city in Madrid (about 1,000 employees) and in Catalonia.

The day has developed with considerable calm and little strength. The S&P 500 and Dax are trading at all-time highs, but the low volume in recent days is not a good sign, as it indicates that strong hands are staying out of the market.

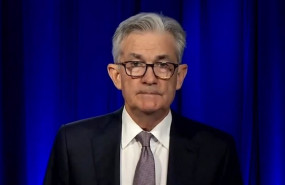

THE MINUTES OF THE FED AND THE ECB

On the other side of the Atlantic, the highlight of the last session was the minutes of the last meeting of the Federal Reserve (Fed). US central bank officials indicated at their last meeting that the accommodative policy will continue until it produces higher employment and inflation, and that it will not adjust based solely on forecasts.

The summary of the meeting indicates that, although officials see that the economy is improving considerably, they believe that much more progress is needed before changing the 'ultra-lax' policy.

Members of the Fed have pointed out that the $ 120 billion a month in bond purchases "is providing substantial support to the economy." In this regard, they have pointed out that "it will probably take some time for substantial new progress to be made towards the Committee's maximum employment and price stability objectives and that, in line with the Committee's results-based guidance, asset purchases they will continue at least at the current rate until then. "

"The FOMC minutes had no impact on equity markets, although in currency markets, the US dollar strengthened as long-term yields rose," said Jeffrey Halley, Asia Pacific analyst at Oanda.

Likewise, the European Central Bank (ECB) has published the minutes of its last meeting, in which members agree that a broad monetary stimulus is still necessary.

On an economic level, the weekly unemployment data in the US has been worse than expected, although analysts continue to anticipate a large job creation in April, as the economy reopens.

TECHNICAL ANALYSIS AND OTHER MARKETS

By technical analysis, the Ibex maintains its good technical aspect and faces resistance at 8,740 points, its annual highs and whose overcoming would open the door to 9,000 points.

Analysts insist that the large Ibex stocks continue to look good, and this is fundamental support for the selective.

The euro increased in value 0.28% and trades at 1.1903 dollars, while Brent oil fell 0.3% to 62.94 dollars. For its part, the ounce of gold rose 0.8%, to 1,755 dollars.

Bitcoin yields 3.5% to $ 57,811 and Ethereum 4% to $ 2,048.

Finally, the yield on the 10-year American bond eases to 1.64% and that of the 10-year Spanish bond falls to 0.33%.