In a volatile session, the Ibex 35 has ended its bearish streak and has begun to try to restructure upwards (+ 0.56%; 8,390 points) thanks to the increases in Bankinter, BBVA or energy companies. The 'orange bank' has increased in value strongly after receiving authorization from the ECB for the listing of Línea Directa, which is expected to take place at the end of April. Cellnex, Grifols, Iberdrola and Enagás also rose notably. On the negative side, the cuts in the tourism sector have stood out, with important falls in IAG or Meliá, and also in Repsol, due to the fall in oil.

- 13.257,100

- 0,17%

The rest of the European indices are trading in red under pressure from Germany's step back, which has decided to interrupt the de-escalation after the increase in Covid-19 cases. Chancellor Angela Merkel and the 16 federal states have agreed to extend the restrictions until April 18. Interpersonal contacts will also be limited to people living together for Easter.

In France or Italy, the evolution of the pandemic is not going well either, unlike the United Kingdom, where vaccination is more spread out. In Spain, the European Commission has asked the Government for consistency in restrictions on domestic and international travel.

THE BANK OF SPAIN REDUCES FORECASTS

In addition, the Bank of Spain estimates that the Gross Domestic Product (GDP) will grow by 6% in 2021, which represents a decrease of 0.8 percentage points compared to the previous forecasts published in December, due to the lower strength of the activity in the short term.

For 2022, the BdE estimates a growth of 5.3% thanks to the carry-over effect of the second half of the current year and a greater recovery in tourism activity, in addition to the additional boost from European funds.

On the other hand, Bankia held its last Shareholders' Meeting on Tuesday ahead of the merger with CaixaBank. Its shares will cease to trade on Friday and the current shareholders will receive securities from the bank controlled by La Caixa.

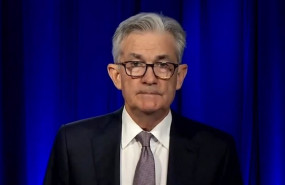

POWELL'S WISE OPTIMISM

Jerome Powell, president of the Federal Reserve (Fed), has appeared this Tuesday before the Committee on Financial Services of the House of Representatives.

"Recently, economic activity and employment indicators have rebounded. The recovery has progressed faster than expected and appears to be strengthening," said the central banker.

"Since January, the number of new cases, hospitalizations and deaths has decreased, and ongoing vaccinnations offer hope of returning to more normal conditions later this year. However, the recovery is far from complete, so we will continue to provide the economy with the support it needs for as long as it is needed. "

AND THE IBEX ...

The selective maintains the short-term correction after drawing annual highs on the 15th. "Despite the recent falls, its technical aspect is still good and we believe that in the next few days we could end up seeing how it covers the downward gap left at 8,493 points, "anticipates César Nuez, an analyst at Bolsamanía and head of Trader Watch.

"We will not see a sign of weakness as long as it remains trading above 8,166 points," he adds.

In other markets, the euro falls in value 0.55% and trades at 1.1865 dollars. In addition, Brent oil falls sharply 4.5%, to $ 61.71, while an ounce of gold falls 0.6%, to $ 1,728. Finally, bitcoin falls 1.5% to $ 55,016, and the yield on the Spanish 10-year bond plummets 14% to 0.29%.