Telefonica pushes Ibex away from finishing 2016 positive

Spanish index closed with a fall of 0.41% to 9,333.60 points

- Telecoms company dropped 1.2%, as did Banco Popular

- The rest of the banking sector closed with moderate losses

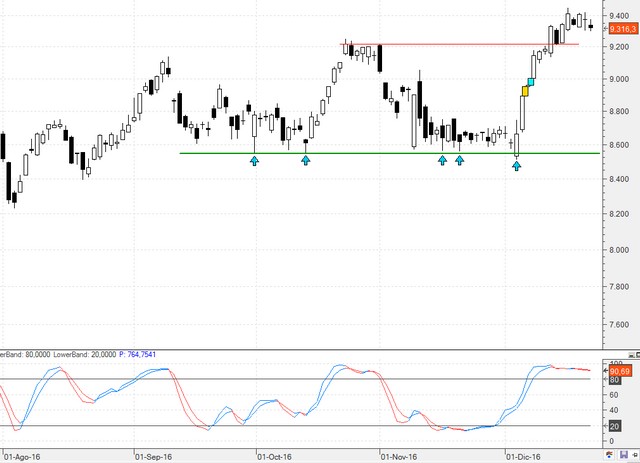

The Christmas Lottery and the banks. Or the banks and the Christmas Lottery. This Thursday's session in the Ibex 35 was marked by losses in the banking sector, which remains hurt by Wednesday's EU sentencing from the "ground clauses" case. A significant fall from Telefonica of 1.2% means that the Ibex faces an uphill battle to finish 2016 positively.

IBEX 35

11.473,900

-

0,33%38,20

- Max: 11.485,70

- Min: 11.446,20

- Volume: -

- MM 200 : 11.294,32

On Thursday the Spanish index closed 0.41% lower at 9,333.60. The worst performing values were Mediaset (-2.8%), and ArcelorMittal (-2%), while Gamesa (+1.8%) and Técnicas Reunidas (+1.1%) led the advances.

Banco Popular dropped 1.2%, a movement which was compounded by a 0.6% loss on Wednesday of this week. After the impact of the European Court of Justice ruling regarding the "ground clauses", most of the banking stocks fell by under 1%.

Much of the focus still remains on the Italian banks, particularly Monte dei Paschi, which looks as if it will be bailed out by the state. Its share price plummeted a further 6% on Thursday.

In the United States, GDP figures showed third quarter growth of 3.5%, its fastest pace in the last two years according to the Department of Commerce. Analysts had expected a figure of 3.3%. Regardless, it has not had the same influence on Wall Street, as the Dow Jones still falls short of the much-awaited 20,000 level.

At a strategic level, GVC Gaesco Beka demonstrated its optimism with its adjustable income figures. In fact, it sees a potential 26% rise for the fundamental Ibex stocks, and has chosen 15 shares in the Spanish market which could help it achieve that. (Telefónica, DIA, Euskaltel, NH Hotels y Cellnex)

TECHNICAL ANALYSIS

All things considered, The Ibex has five more opportunities to finish the year on the right side of the 9,544 level. The bad news is that BBVA has taken a backwards step after being the most badly affected after Wednesday's EU ruling. It has moved away from its higher resistance of 6.65 euros, according to Bolsmania technical analyst José María Rodríguez.

"Without doubt, we are in a good position to return higher numbers from some of the heaviest stocks in European markets," said Rodríguez.