The Ibex (+ 0.2%) consolidates its bullish trend and reaches 9,400 points

The selective continues showing signs of solidity in the short and medium term

The Ibex 35 rose 0.23% to 9,363.50 points after marking an intraday high of 9,400. The pressure from banks and Telefónica has prevented the index from registering a more positive behavior, despite the increases of Inditex (+ 0.8%), BBVA (+ 0.41%) and Iberdrola (+ 0.36%). In addition, Técnicas Reunidas has risen 2.66% after reaching a contract of 1,500m dollars. The selective consolidates the increases of 1.1% on Monday.

IBEX 35

11.473,900

-

0,33%38,20

- Max: 11.485,70

- Min: 11.446,20

- Volume: -

- MM 200 : 11.299,24

In Spain, the Bankia trial (-0.3%) continues to focus investors' attention. The bank has assumed a package of 262,000 shares from executions of sentences for that controversial IPO from the entity before being rescued.

In addition, Santander celebrates its 'Investor Day' on Wednesday. Credit Suisse analysts expect the entity to "increase the visibility of the outlook for profits in Brazil and the expectations of the Spanish division."

In other markets, Brent oil advanced 0.4% to $ 69.30, while the euro fell in value 0.25% to $ 1.1188.

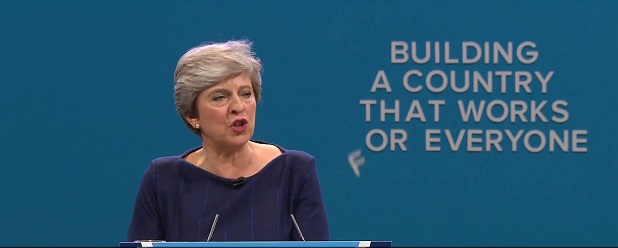

BREXIT CONTINUES AS MAIN FOCUS

Brexit remains 'the big issue'. The British Parliament voted on Monday against alternatives to Theresa May's plan. The House of Commons confirmed again that none of the proposed options has a majority support to ensure its approval, although the amendment on the customs union was rejected only by three votes. After the votes, the pound fell in value but very slightly.

After that new 'no', May meets today with her cabinet. Investors will be alert during the day to any statement that may occur. It is speculated that the intention of the 'premier' is to submit her plan to a new vote (the fourth already) this same Wednesday.

THE MACRO DATA

The ISM manufacturing that was known on Monday on Wall Street served to boost the indexes, which rose more than 1%. According to experts, this reference "reinforced" the positive sentiment that had been produced by good macro data in China. "The second largest economy in the world reported a surprising return to growth in its manufacturing sector on Monday," analysts say.

In Spain, unemployment fell by 33,956 people in March, its lowest decline in this month since 2014. On the international scene, this morning the central bank of Australia has kept the rates unchanged at 1.5%.

On the other hand, the International Monetary Fund (IMF) will lower its macroeconomic forecasts, which it will publish next week, given the "delicate moment" that the world economy is going through, which has continued losing momentum during the last months. Although the institution rules out that a recession will occur in the short term.

TECHNICAL ANALYSIS OF THE IBEX 35

"Without making a lot of noise, our index continues to recover positions, at a slow pace, but surely, there is technically no news to add compared to what was said on Monday, as the price is moving away without making much noise from the support of 9,100 points and is approaching the resistance of 9,530 points ", says José María Rodríguez, analyst of 'Bolsamanía'.

"The daily oversold is still high and the important thing is that the stochastic oscillator has turned higher, which leaves the door open for the price to continue climbing positions, with a target in the upper part of the short-term bullish channel: now in the approximately 9.620 points ", adds this expert.

"Although it seems obvious, it should be noted that since the minimums at the end of December, the price is building again and again increasing minimums and maximums, and this way it does not fall", concludes Rodríguez.