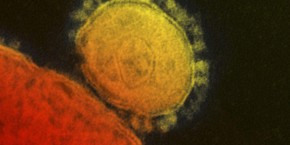

Ibex (-0.5%) holds 9,600 points despite doubts about the Chinese virus

The possible consequences of this new disease worry investors

Ibex 35 has fallen by 0.49%, to 9,611.30 points, after marking an intraday low at 9,550 integers. The economic optimism of Donald Trump from Davos and the good German ZEW fail to counteract the bad news from Asia, where an unknown respiratory virus has already killed six people and threatens to spread throughout the country. Moody's has cut the rating of Hong Kong, which has led to sharp falls in the Hang Seng. To all this we must add the truce between the US and France on the 'Google rate' and the latest business results including UBS.

IBEX 35

11.711,800

-

0,47%55,20

- Max: 11.767,60

- Min: 11.679,60

- Volume: -

- MM 200 : 11.125,61

The Swiss bank has not fulfilled its forecasts for 2019 (falls 5% on the stock exchange) despite the fact that the fourth quarter profit has more than doubled. These results arrive in the middle of the renovation that is being carried out by the entity of its investment banking and wealth management divisions, with a significant cut in jobs.

In Asia, the different indexes have ended the day with significant falls due to the concern of the spread of a coronavirus in China that is being compared with the outbreak of SARS that killed 800 people between 2002 and 2003.

In addition, Hong Kong shares have led the losses (-2.8%) after the Moody's rating agency has reduced the rating of the autonomous region to 'Aa3' from 'Aa2' due to governance problems and riots social.

Within the Ibex most titles are listed in negative. Especially noteworthy are the sharp declines in IAG or Amadeus, both affected by the situation in China, as these health problems impact on the airline or travel sector. Aena also falls hard. Bolsamanía publishes today that it rules out starting a new partial privatization during this term.

At the Davos Forum, Donald Trump has pulled out his chest and said that the US is leading global growth. He has also asked the Fed to continue lowering interest rates and has reiterated that the impeachment process against him "is a witch hunt."

For Spain, Deutsche Bank expects a growth of the economy of 1.6% this year, in a context of deceleration of the world economy, but with a very low risk of recession, according to its' Economic outlook and investment strategy for 2020 '.

Finally, as for the macro data of the day, the ZEW in Germany has surprised to the upside, with a rise in economic sentiment to 26.7 from 10.7 and compared to the estimate of 15. In other markets, oil Brent falls 0.5%, to $ 64.88. In addition, the euro appreciates 0.01% and changes to $ 1.1095. Finally, the profitability of the 10-year Spanish bond falls slightly to 0.43%.

IBEX TECHNICAL ANALYSIS 35

"The falls of this Tuesday in the Ibex are not worrisome because they actually serve to fill the bullish gap that this left in the session last Friday, at 9,570 points. Moreover, we continue within the side that we have been moving for more than a month, with support at 9,465 points and resistance at 9,700, although it is true that the support can be extended to the area of 9,400 points, so as long as we do not pierce the 9,400 points in closing prices, nothing has happened here, "says José María Rodríguez, expert of Bolsamanía ,.

"And above we have the 9,700 points that have been tested, unsuccessfully, several times recently. And until we jump over we will not have the confirmation of the start of a new impulse with a target of 10,000 points. Therefore, and as a summary, we remain lateral. We are not able to overcome resistance, but neither to perforate supports ", concludes this expert.