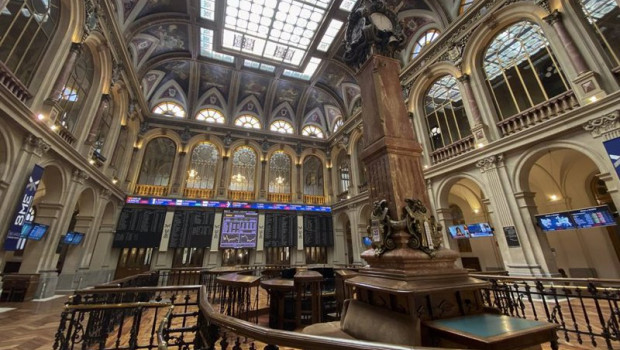

The Ibex is flat and on the way to closing a week of doubts and weakness

The selective has its next support at 6,450 points

The Ibex is trading with slight falls this Friday (6,640 points) and is heading towards a clearly negative weekly close. For the moment, in the accumulated of the last four sessions, and waiting for what finally happens this Friday, the selective falls4%. Monday was a disastrous session, conditioned by the news about illegal bank practices, doubts about the vaccine, fears about the extension of the coronavirus outbreak ... and since that day the Spanish index has been unable to recover.

IBEX 35

11.473,900

-

0,33%38,20

- Max: 11.485,70

- Min: 11.446,20

- Volume: -

- MM 200 : 11.299,24

"Stock exchanges have spent most of the week on an emotional roller coaster, with investors taking significant whiplash," summarizes Michael Hewson, chief analyst at CMC Markets in London. On the other side of the Atlantic, the Federal Reserve (Fed) has shown its concern about the economic situation in the United States and has asked Republicans and Democrats to reach an agreement for a package of aid to alleviate the effects of Covid-19, an agreement that it has not just been ratified. The latest news about it has to do with the proposal, of 2.2 trillion dollars, that the Democrats have written, according to Bloomberg.

Technically, the Ibex has lost the support of 6,900 points this week and remains very close to the base of the channel, around 6,450 points. The experts of Bolsamanía warn that, if it loses this level, it would go for the minimum of the year, at 5,814 points, something they consider "probable". Above, on the resistance side, the upper part of the channel is currently passing 7,200 points, approximately.

During this week the bad technical aspect of the large Ibex values has been confirmed. Although BBVA has rebounded (today it rises another 2%) after improving its forecasts for the year thanks to the situation in Mexico and after opening the door to the payment of the dividend, both this entity, such as Santander or Telefónica, are sinking in the year and show a discouraging aspect that suggests that the falls in the Spanish index will probably continue.

IAG has also had a week of constant declines (today it falls another 1.5%) in full capital increase and while struggling not to lose the euro per share, while other large titles, such as Inditex or Repsol, have also suffered.

Next week the month will close. If things do not change substantially, the Ibex will round-up a loss for September. At the moment it falls close to 5%.