Moderate falls for the Ibex, which does not find positive catalysts

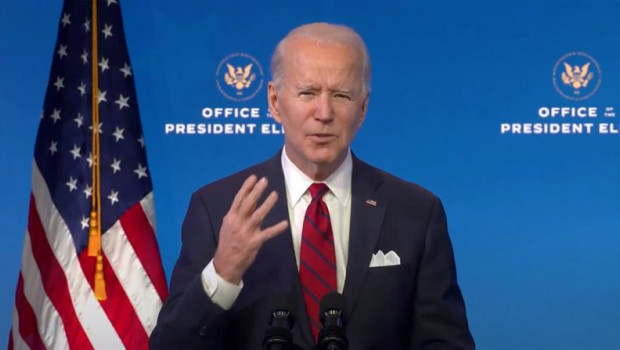

Everybody, pending Joe Biden's inauguration

The Ibex 35 fell 0.1%, to 8,189 points, and maintains the slightly bearish inertia that it has registered in recent days. After rising 4% in the first week of the year and exceeding 8,400 points, the index has slowed down since then, waiting for some positive catalyst that allows it to continue gaining positions.

IBEX 35

11.720,900

-

-1,50%-178,40

- Max: 11.877,20

- Min: 11.703,80

- Volume: -

- MM 200 : 11.341,45

Bankia and CaixaBank, which will publish their results next week, have been the most bearish, while their shareholders await news about their integration process.

A bad day also for the electricity companies, as Naturgy, Iberdrola and Endesa have appeared among the most bearish stocks.

On the positive side, Repsol has led earnings after posting an 8.5% drop in its annual oil production during 2020, although the company has discounted a bullish day for 'black gold'.

In addition, business results have continued to be published. Today it was Morgan Stanley's turn, which rose after exceeding forecasts. And Netflix rebounds with enthusiasm after announcing its resuts last night and reporting over 200 million new subscribers. Tomorrow, Bankinter kicks off the results in Spain.

In addition, on a macro level, the UK CPI for December and the CPI for the same month for the Euro Zone have been published, confirming a deflation of 0.3% in 2020.

Internationally, the world is awaiting the inauguration of Joe Biden as president of the United States. The ceremony will be marked by the absence of Donald Trump, who has left for Florida and has been fired, pardoning his former adviser, Steve Bannon, as the final act of his mandate.

Biden arrives with the promise of acting decisively in what he has to do with the stimuli to stop the impact of the pandemic. His new Treasury Secretary, Janet Yellen, said Tuesday that, in the current circumstances, "the smartest thing to do is to act big." This has been well received by Wall Street, which is rising moderately.

Yellen also referred to China, calling it "the great strategic competitor" of the US, adding that it is ready to tackle the Asian giant's bad business practices in collaboration with US allies.

"Now it is up to the Democrats, under Joe Biden, to take up the challenge of healing the country and uniting a society that seems incapable, or does not want to hear what the other side has to say. It is a tough job for any president and much more for one who is taking over at a time of global pandemic as well as economic crisis, "explains Michael Hewson, chief analyst at CMC Markets.

Asia has lived a session without shocks and with a mixed sign. There has been talk of the comeback of billionaire Jack Ma, who has made his first public appearance in almost three months, and the Central Bank of China rate meeting, which has kept them unchanged.

Finally, as for the Ibex and its technical aspect, it is losing the support of 8,200 points. "In the short term we do not rule out ending up seeing how the upward gap that was left last day 6 at 8,091 points is covered. It is important that the Spanish selective does not leave the 8,000 point level, since we could end up seeing a continuation of the falls up to the level of 7,663 points. To confirm a continuation of the rises, we should wait for a close above 8,439 points ", explains César Nuez, analyst at Bolsamanía and head of Trader Watch.

In other markets, Brent oil rises 0.9% to $ 56.41, while the euro falls in value 0.26% and trades at $ 1.2096. In addition, the profitability of the 10-year Spanish bond is trading at 0.07%.